SHARON’S CORNER

What a week it has been...two snow days and schools were even closed which is unheard, at least for those of us in the Tri-Cities! With tax season in full swing, my blog writing is on hold temporarily but here are a couple that I updated recently. Gifts & Awards because who doesn’t like company deductible presents and what great timing for tax season with the Top Missed Tax Deductions. I’ve always got an ongoing list of topics but open to taking suggestions for what you might want to learn about so drop me an email with your topic and it could be my next blog or NORAH’S feature question.

Have a question? Email or call us. And remember to check out our blogs, checklists and social media pages for more information on all things small business, tax, accounting and the Tri-Cities community.

WORKING FROM HOME EXPENSES: Employment Expenses

WORKING FROM HOME EXPENSES: Employment Expenses

The $2/day flat rate method available to claim expenses for employees working from home was a temporary administrative measure only available from 2020 to 2022; it is no longer available in 2023. As such, employees working from home can only use the detailed calculation when claiming expenses.

For 2023 and subsequent years, a deduction can only be claimed where one of the following criteria is met:

- the work space was the place where the individual principally (more than 50% of the time) performed their duties of employment; or

- the individual used the space exclusively during the period to earn employment income and used it on a regular and continuous basis for meeting clients, customers or other people with respect to employment.

CRA indicated that they would consider i) to be met by employees who were required to work from home more than 50% of the time for a period of at least four consecutive weeks in the year.

Action: The $2/day temporary flat rate method cannot be used by employees to claim home office expenses in 2023. Instead, receipts and records must be kept to make claims under the detailed method.

AUTOMOBILE DEDUCTION & BENEFIT RATES: 2024 Limits Released

Various automobile deductions and taxable benefit rates are limited to amounts prescribed by the Department of Finance annually.

On December 18, 2023, the 2024 limits were announced as follows:

- The limit on the deduction for non-taxable allowances paid by an employer to an employee using a personal vehicle for business purposes will increase in 2024 by 2 cents to 70 cents/km for the first 5,000 km driven and to 64 cents for each additional km. For Yukon, the Northwest Territories and Nunavut, the tax-exempt allowance will continue to be 4 cents/km higher, which is 74 cents for the first 5,000 km driven and 68 cents for each additional km.

- The ceiling on the capital cost for CCA of most passenger vehicles will increase to $37,000 from $36,000, and the limit for zero-emission passenger vehicles will remain at $61,000.

- The limit on leasing costs will increase to $1,050/month (from $950/month) for new leases entered into on or after January 1, 2024.

- The maximum allowable interest will increase to $350/month (from $300/month) for new loans entered into on or after January 1, 2024.

- The general prescribed rate used to determine the taxable benefit relating to the personal portion of automobile operating expenses paid by employers will remain at 33 cents/km. For taxpayers employed principally in selling or leasing automobiles, the rate will remain at 30 cents/km.

Action: Compare automobile allowances and other payments made against the limits to determine whether expenditures that do not reduce tax are being made.

PERSONAL SERVICES BUSINESS: CRA Education Initiative

PERSONAL SERVICES BUSINESS: CRA Education Initiative

In general, a personal services business (PSB) exists where the individual performing the work would be considered to be an employee of the payer if it were not for the existence of the individual’s corporation. These workers are often referred to as incorporated employees. Where it is determined that the income is earned from a PSB, the corporate tax rate increases significantly (potentially as high as 39% over the small business rate, depending on the province). In addition, significantly fewer expenditures are deductible against the income.

Since 2022, CRA has been conducting an educational pilot project in respect of PSBs. They have recently published findings from the project and highlighted future planned phases

Phase I – Identifying Companies That Hire PSBs

Phase I of the project was conducted from June to December 2022. The results were as follows:

- approximately 10% of participating corporations were likely to be carrying on PSBs;

- approximately 64% of potential PSBs were incorrectly claiming the small business deduction (an average of $16,711 of additional federal corporate tax would be payable if this were corrected);

- nearly 74% of potential PSBs work in the following three industries:

- transportation and warehousing (35%), with 95% of these working in freight trucking;

- professional, scientific and technical services (26%); and

- construction (13%).

Phase II – Identifying Potential PSBs

CRA indicated that Phase II is planned for October 2023 to June 2024, and will examine approximately 2,100 randomly selected corporations identified as potential PSBs. The examination will include a voluntary interview and focus on the 2022 tax year. CRA indicated that they hope to gain greater insight into how and why PSBs operate the way they do.

Phase III – Assisted Compliance For PSBs

CRA indicated that the timing of Phase III has not yet been determined. They expect to address the 2022 and subsequent tax years with continued education, review of PSBs and assisted compliance of non-compliant PSBs.

Action: : Identification of PSBs has become a focal point for CRA. If there is a risk of your corporation carrying on a PSB, inquire as to the corporation’s exposure and potential mitigation strategies.

CANADA DENTAL CARE PLAN (CDCP): New Income-Tested Benefit

CANADA DENTAL CARE PLAN (CDCP): New Income-Tested Benefit

On December 11, 2023, Health Canada issued details on the Canada dental care plan that would cover a wide variety of dental services for certain Canadian residents. The plan will be rolled out from late 2023 to 2025.

To be eligible, the individual and their spouse or common-law partner (if applicable) must meet all of the following conditions:

- have an adjusted family net income (AFNI) of less than $90,000;

- be a Canadian resident for tax purposes;

- have filed their tax return in the previous year; and

- not have access to dental insurance, meaning that it is not avail- able through the taxpayer’s or a family member’s employer or pension, or not purchased through a group plan.

Eligibility for children under 18 will be determined by their parents’/ guardians’ eligibility.

Individuals will need to meet the eligibility requirements annually. More information on the annual reassessment process will be provided by the government at a later date.

The CDCP will pay for eligible services provided by an oral health provider (such as dentists, denturists, dental hygienists and dental specialists), less a portion that is to be paid directly by the patient (the “co-payment”). No co-payment is required if AFNI is under $70,000. The co-payment starts at 40% for AFNI between $70,000 and $79,999 and increases to 60% for AFNI between $80,000 and $89,999.

Oral health providers are encouraged to follow the CDCP fees, which are not the same as the provincial and territorial fee guides, so their patients do not face additional charges at the point of care. Oral health providers who have enrolled with CDCP will bill the plan directly. Health Canada noted that patients should ask if the provider has enrolled in the CDCP when booking their appointment to limit unexpected out-of-pocket payments.

The program will be first rolled out to seniors with application invitation letters starting in December 2023. Eligible seniors will be able to engage in covered services as early as May 2024. Those with a disability tax credit certificate (T2201) or under 18 years of age can begin to apply as of June 2024. The remaining eligible residents will be able to apply in 2025.

CRA noted that only those who are 70 years old or older by March 31, 2024, have AFNI of less than $90,000 for 2022, and were Canadian tax residents for 2022 will receive the initial application instruction letters.

Once an individual has applied and is determined to be eligible, Service Canada will share the individual’s information with Sun Life, the contracted service provider, for enrolment into the CDCP. Eligible individuals will receive a member card, and be notified of the start date of their coverage. The start date will vary based on when each group can apply, when the application is received and when enrollment is completed.

Oral health providers will be able to enroll voluntarily as a participating CDCP provider directly with Sun Life in early 2024. Details on this process will be available on Health Canada’s webpage when enrollment opens. Oral health providers enrolled in the CDCP will be required to submit the claims directly to Sun Life for payment rather than having patients seek reimbursement from Sun Life for services covered under the plan.

Action: If you are an eligible individual, apply for this new benefit when invited. If you are an oral health care provider, consider enrolling as a provider in the plan.

T-SLIPS: Filing & Distribution Issues

Various changes and issues have arisen in respect of T-slips to be filed and processed for the 2023 year.

Dental Benefits

Dental Benefits

Beginning with the 2023 year, issuers of the T4 Statement of Remuneration Paid and T4A, Statement of Pension, Retirement, Annuity, and Other Income must report whether the recipient or any of their family members were eligible to access dental insurance or dental coverage of any kind (including health spending and wellness accounts) from their current or former employment.

The T4 will include new box 45, employer-offered dental benefits.

The T4A will include a new box 015, payer-offered dental benefits. This box must be completed if an amount is reported in box 016, pension or superannuation.

CRA indicated that it is mandatory to indicate whether the employee/former employee or any of their family members were eligible, on December 31 of that year, to access any dental care insurance, or coverage of dental services of any kind, that the employer offered.

The employer/issuer must select which of the following scenarios apply.

- Not eligible to access any dental care insurance, or coverage of dental services of any kind

- Payee only

- Payee, spouse and dependent children

- Payee and their spouse

- Payee and their dependent children

Electronic Distribution

In a December 13, 2023 update to CRA’s webpage, CRA discussed the ability to distribute T4, T4A, T5 and T4FHSA slips using the issuer’s secure electronic portal without obtaining written or electronic consent from the employees or recipients. However, using a secure electronic portal is not available where any of the following situations exist:

- the employee or recipient requested that paper copies of the slips be provided;

- the employee or recipient cannot reasonably be expected to have access to the slips in electronic format at the time the slips are issued; or

- for T4s, if the issuer distributes the T4 when the employee is on extended leave or is a former employee at the time the slip is issued.

Employers/payers must also provide the option to receive these slips in paper form.

If distributing these slips by email, the employer/payer must receive consent in writing or electronic format before sending by email.

Electronic Filing Thresholds

Effective January 1, 2024, certain information returns must be filed electronically with CRA where more than 5 information returns (reduced from 50) of a particular type are required for a calendar year. The impacted information slips include forms NR4, T5007, T5018, T4A-NR, T5, T5013, T4A, T4 and T3. A penalty of $125 will apply where between 6 and 50 slips are filed on paper.

Errors On T-Slips

Errors On T-Slips

In a recent communication, CRA addressed the concern that auditors and appeals officers may base a decision on issued T-slips without considering the possibility that the issuer made an error in their preparation

CRA stated that it is the taxpayer’s responsibility to verify the validity and accuracy of the information slip. If the taxpayer notices an error, the taxpayer should contact the issuer to attempt to discuss/resolve the issue. CRA noted that they cannot validate the accuracy of a slip as the relevant information to do so is retained by the issuer and the taxpayer. If the issuer refuses to correct the form, the taxpayer can inform CRA by filing an employee complaint with the employer accounts and services section.

When a taxpayer objects to CRA’s assessment/reassessment, the taxpayer must provide the reason for the objection. The appeals officer should investigate the accuracy of the information slip when it is part of the disputed issue. The appeals officer may also ask the taxpayer to provide representations.

Action: Various changes to T-slip completion, filing and distribution are effective for 2023 slips, filed in early 2024. Ensure that these changes are incorporated into your business processes

NEW TRUST REPORTING: Unexpected Exposure

Changes requiring more trusts (and estates) to file tax returns and more information to be disclosed, first proposed in the 2018 Federal Budget, were delayed several times in the legislative process. The final rules (that are now law) first apply for 2023, with a filing deadline of April 2, 2024. As such, many trusts and estates (including many arrangements not commonly considered “trusts”) will be required to file for the first time in early 2024.

Required reporting has been expanded to include situations where a trust acts as an agent for its beneficiaries (often referred to as a bare trust). This occurs when the person on title or holding the asset is not the true beneficial owner but rather holds the asset for the benefit of another party. There are many common situations that may constitute reportable bare trusts in which no lawyer or written agreement may have ever been involved or drafted. Many parties involved in a bare trust arrangement may not realize that they are, much less that there may be a filing requirement with CRA.

The following lists some examples of potential bare trust arrangements; CRA has not commented on several of the examples below. It is uncertain how they will interpret and enforce the law.

- a child on title of a parent’s home (without the child having beneficial ownership) for probate or estate planning purposes only;

- parent on title of a child’s property (without the parent having beneficial ownership) to assist the child in obtaining a mortgage;

- one spouse being on title of a house or asset although the other spouse is at least a partial beneficial owner;

- a parent or grandparent holding an investment or bank account in trust for a child or grandchild;

- a corporate bank account opened by the shareholders with the corporation being the beneficial owner of the funds;

- a corporation being on title of an individual’s real estate, vehicle or other asset, and vice-versa;

- assets registered to one corporation but beneficially owned by a related corporation

- use of a nominee corporation for real estate development purposes;

- a property management company holding operational bank accounts in trust for their clients, or individuals managing properties for other corporations holding bank accounts for those other corporations;

- a lawyer’s specific trust account (while a lawyer’s general trust account would largely be carved out of the filing requirements, a specific trust account would not); and

- a partner of a partnership holding a bank account or asset for the benefit of all the other partners of a partnership.

In addition to bare trust arrangements, other trusts that have not had to file in the past may have a filing obligation under these expanded rules.

Exceptions from filing a return for trusts and bare trust arrangements are available in limited cases. If filing is required, the identity and residency of all the trustees, beneficiaries, settlors and anyone with the ability (through the terms of the trust or a related agreement) to exert influence over trustee decisions regarding the income or capital of the trust must be disclosed.

Failure to make the required filings and disclosures on time attracts penalties of $25 per day, to a maximum of $2,500, as well as further penalties on any unpaid taxes. New gross negligence penalties may also apply, being the greater of $2,500 and 5% of the highest total fair market value of the trust’s property at any time in the year. These will apply to any person or partnership subject to the new regime.

CRA has recently indicated that, for bare trusts only, the late filing penalty would be waived for the 2023 tax year in situations where the filing is made after the due date of April 2, 2024. However, CRA noted that this does not extend to the penalty applicable where the failure to file is made knowingly or due to gross negligence. As there is limited guidance as to who would qualify, it is recommended that disclosures should be made in a timely manner.

Action: Consider whether you may have a bare trust arrangement. If so, or if you are unsure, contact us to discuss

FARM LOSSES CAN BE RESTRICTED: May Apply Even When Significant Time & Cash Is Invested

FARM LOSSES CAN BE RESTRICTED: May Apply Even When Significant Time & Cash Is Invested

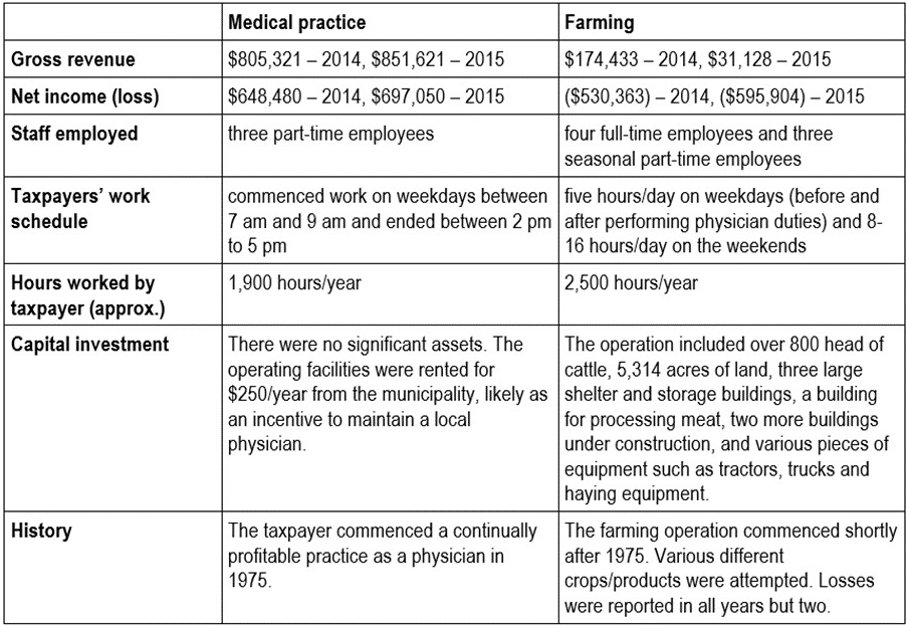

A November 8, 2023 Tax Court of Canada case considered whether a taxpayer’s losses from farming activities deductible against non-farming income were restricted to the $17,500 ($2,500 plus half of the next $30,000) permitted by the restricted farm loss rules for the 2014 and 2015 years. The restriction applies where the taxpayer’s chief source of income for a taxation year is neither farming nor a combination of farming and some other source of income that is a subordinate source of income for the taxpayer.

The taxpayer was a physician but also operated a farm that produced organic beef. The taxpayer provided the following relevant details.

Taxpayer Loses

The Court noted that the taxpayer’s farm activities took place before and after normal working hours and gave way to her medical practice if an issue arose that required her attention. As such, the Court found that the centre of the taxpayer’s routine was her medical practice. Further, the Court noted that the farm was only commenced after the medical practice and that all of the investment in the farm came from the medical practice. The farm required the cash inflow of the medical practice to survive. The farming business had always been subordinate to the medical practice as a source of income, rather than the other way around, and there was no demonstration that this would change in the foreseeable future. As such, the Court determined that the restricted farm loss rules would apply and the taxpayer’s deduction would be limited to $17,500.

Court’s Additional Commentary

The Court noted that the result was most unfortunate as it resulted in the denial of a loss for a bona fide farming business that would have been available to the operator of any other business. In particular, the Court noted how this case demonstrated the difficulty in growing a viable farming business with the current restricted farm loss rule punishing those willing to put in the significant time and capital required to do so.

Action: If farming activities consume a significant portion of your resources but you earn income from other significant sources as well, seek consultation to determine if farming losses may be restricted.

TAX TICKLERS

- The 2024 RRSP contribution limit is $31,560, requiring earned income in 2023 of at least $175,333. The 2025 limit will be $32,490 (requiring earned income in 2024 of at least $180,500).

- The annual TFSA contribution limit for 2024 is $7,000.

- The annual interest rate charged by CRA on late tax and installment payments has increased to 10% for the first quarter of 2024. Additional penalties may apply on underpaid installment payments.

- Over 6,100 audits on COVID-19 wage subsidies have been completed or are in progress. In terms of dollar figures, $8.9 billion in claims have been audited, and $7.5 billion in claims are currently being audited. Of the audited claims, $458 million of claims have been denied.

**This publication is a high-level summary of the most recent tax developments applicable to business owners, investors, and high-net-worth individuals. This information is for educational purposes only. As it is impossible to include all situations, circumstances and exceptions in a newsletter such as this, a further review should be done by a qualified professional. No individual or organization involved in either the preparation or distribution of this letter accepts any contractual, tortious, or any other form of liability for its contents. For any questions… give us a call.