“I heard there are more changes coming to CPP. How will this impact me?”

The CPP enhancement was introduced in 2019 where it was gradually increased from 4.95% to where it is now at 5.95% for 2023.

CPP has always had two components - one portion is paid by the employee and one portion is paid by the employer but if you were a sole proprietor, you paid double for both the employee and employer portions.

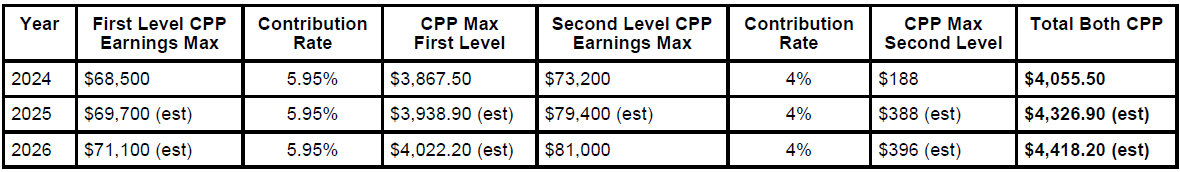

The earnings in which CPP is calculated on also increases year-over-year. But now in addition to the yearly earnings increases, there is a second level of CPP that some will have to pay starting in 2024. This second level of CPP is 4% per employee and employer and 8% for sole proprietors so when you earnings are greater than the first maximum CPP threshold (68,500 for 2024), the second level of CPP kicks in, up until earnings of $73,200 (2024). The maximum additional CPP for 2024 is $188 for each employee and employer or $376 for sole proprietors.

For 2024, the maximum earnings for the additional CPP is 7% higher than the first level of CPP but in 2025, that will double to 14% over the first level of CPP. For now, they say that for 2026 both CPP earnings thresholds will increase incrementally each year but the contribution rate will remain the same.

If you are an employee or sole proprietor who does not max out their CPP year-over-year, then this likely won’t impact you but if your income is greater than the first level of CPP, then you will be paying more which looks like the following.

In 2024, if your income is greater than $73,200, the maximum you will pay is $4,055.50 as an employee or $8,111.00 as a sole proprietor. In 2025, based on their projections, if your income is greater than $79,400, the maximum you will pay is $4,326.90 as an employee or $8,653.80 as a sole proprietor.

Basically, if your earnings increase, year-over-year your CPP will increase too, whether you pay the first level only or both.

Have a question? Email or call us. And remember to check out our blogs, checklists and social media pages for more information on all things small business, tax, accounting and the Tri-Cities community.

***This blog is for information only and not to be used as tax advice or planning without first seeking professional advice. Information is subject to change without notice.