“I am getting ready to prepare the T4s for my business and am seeing new boxes on them?”

“I am getting ready to prepare the T4s for my business and am seeing new boxes on them?”

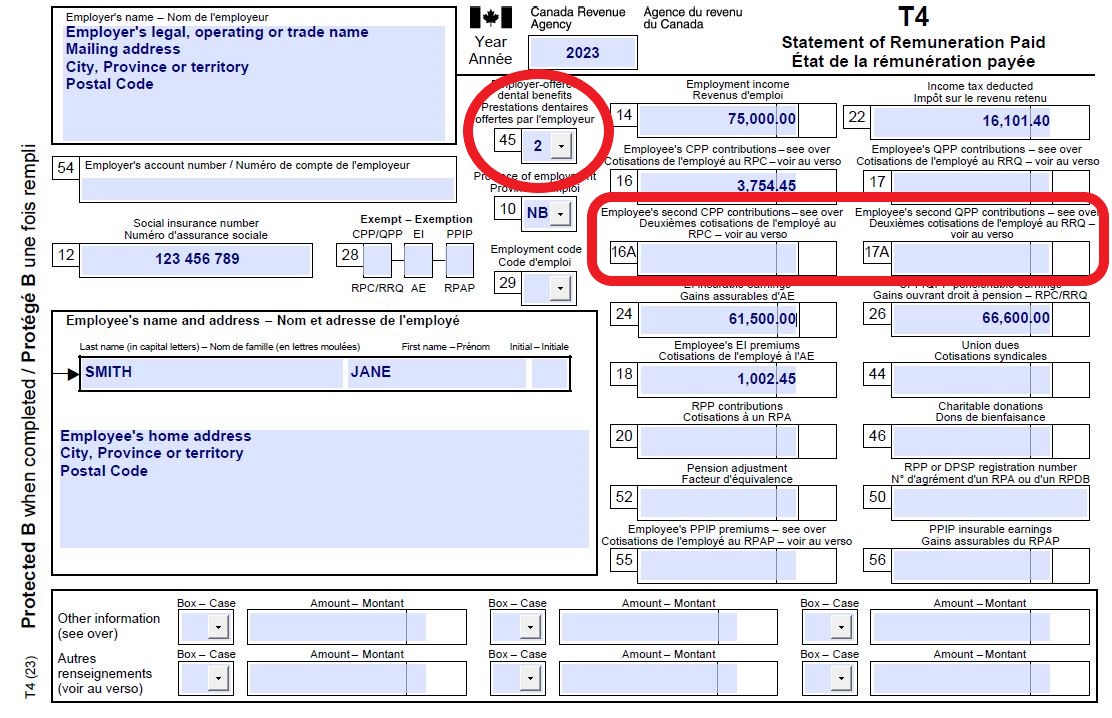

You are definitely not seeing things. The 2023 T4 slips have a few new boxes and a very important reminder to be aware of too.

Box 45 is mandatory for calendar year 2023 and onwards. It is used to indicate whether your employee or any of their family members were eligible for dental benefits, on December 31 of that year. There are 5 codes to consider although for 2023, only code 1 is mandatory.

- Not eligible to access any dental care insurance, or coverage of dental services of any kind

- Payee only (payee referring to the employee)

- Payee, spouse, and dependent children

- Payee and their spouse

- Payee and their dependent children

This is likely being used by CRA to ensure that no one is using the Canada Dental Benefit program that already has a dental plan in place.

Box 16A (CPP) and 17A (QPP) are for the enhanced CPP/QPP that is effective for January 1, 2024 onwards. Hopefully added early not to confuse anyone but rather to bring attention to them so small businesses are prepared for the 2024 tax year. What this means is though, is that anyone making over the maximum pensionable earnings will start paying more for CPP, employer portions as well. 2024 is estimated to be $188 for each employee and employer.

Lastly, mandatory as of January 1, 2024, all employers filing more than 5 slips are required to electronically file electronically including T4, T4A, T5 and T3 slips. The penalty ranges between $125 to $2,500 depending on how many slips are filed so make sure you are filing your 2023 tax slips using CRA’s Internet File Transfer or Web Forms.

Have a question? Email or call us. And remember to check out our blogs, checklists and social media pages for more information on all things small business, tax, accounting and the Tri-Cities community.

***This blog is for information only and not to be used as tax advice or planning without first seeking professional advice. Information is subject to change without notice.