In Canada, every person is required to file a personal tax return. There is no age limit. Even at the age of 2, if you have taxable sources of income, you are required to file. Now most people do not file until they are working or have other sources of income to report. But sometimes there are reasons even before that; when you are a student working a part-time job, attending a post-secondary school or if you are not a student but are turning 19, you may want to file to receive Benefits (aka “FREE” money) from the government, like the GST Credit, Provincial Tax Credit (BC residents) or Canada Workers Benefit.

In Canada, every person is required to file a personal tax return. There is no age limit. Even at the age of 2, if you have taxable sources of income, you are required to file. Now most people do not file until they are working or have other sources of income to report. But sometimes there are reasons even before that; when you are a student working a part-time job, attending a post-secondary school or if you are not a student but are turning 19, you may want to file to receive Benefits (aka “FREE” money) from the government, like the GST Credit, Provincial Tax Credit (BC residents) or Canada Workers Benefit.

What this means is that at some point in your life, you will HAVE to file a personal tax return so EVERYONE should have a general understanding of how taxes work.

Yes, we hear you…it gets really confusing when phrases like “total income”, “net income”, “taxable income”, “tiered tax rates”, “deductions”, “credits”, “benefits”, and more are thrown around. It also gets confusing when a benefit is called a credit and vice versa.

Yes, we hear you…it gets really confusing when phrases like “total income”, “net income”, “taxable income”, “tiered tax rates”, “deductions”, “credits”, “benefits”, and more are thrown around. It also gets confusing when a benefit is called a credit and vice versa.

So, let me help you understand some of the basics. Since we all like making money, let’s start with income.

Total Income

This is the total amount you earn before anything is deducted. When you are an employee, typical deductions before you receive your paycheque might include Canada Pension Plan (CPP), Employment Insurance (EI), federal and provincial taxes.

Let’s say, your employer pays you an annual salary of $60,000 but you only receive $48,000. Regardless of the deductions, your Total Income is $60,000 for tax purposes.

Where there is a difference for adding up the Total Income for tax purposes is when you report business, rental, farming or fishing income. With these sources of income, your Total Income is the amount reported after the related expenses have been deducted from the income earned or received. Or with capital gains, you would report the difference between what you paid versus what you sold the shares for.

Where there is a difference for adding up the Total Income for tax purposes is when you report business, rental, farming or fishing income. With these sources of income, your Total Income is the amount reported after the related expenses have been deducted from the income earned or received. Or with capital gains, you would report the difference between what you paid versus what you sold the shares for.

Deductions

Next, we have Deductions which are often tangled and confused with Credits and Benefits but they are different than Credits while Credits are different than Benefits.

Deductions reduce your Total Income to determine either your Net and/or Taxable Income. Deductions are offset dollar for dollar against your Total Income. Some deductions have maximum thresholds (i.e. RRSP contributions, childcare) while others have no maximum and are based on what you paid (i.e. union dues).

Net Income

This is your Total Income after certain types of Deductions. These deductions might include RRSP or pension contributions, childcare, spousal support payments (signed agreement required), union dues, moving expenses, employer portion of CPP if you are self-employed and more. Once we deduct these items, you have your Net Income.

Taxable Income

This is your Net Income after other types of Deductions. These might include capital losses from prior years (which offset current year capital gains), northern resident deductions, workers compensation benefits (WCB) payments, social assistance payments, etc.

While we recognize that Net and Taxable Income both have Deductions available that reduce your Total Income, there are reasons where knowing the difference between Net and Taxable Income is important but to keep this explanation as simple as possible, we will leave it at that for now.

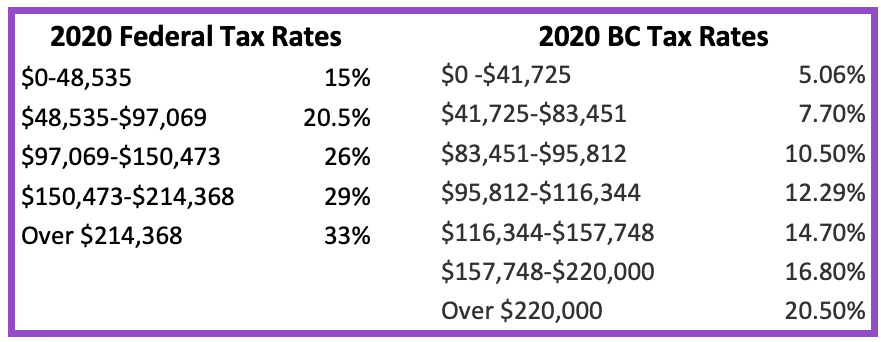

Once we have determined your Taxable Income, your taxes can then be calculated. When you chat with friends or family, you are likely to hear talk about how they pay tax at say 25% or how some are paying more than 50% in BC. But in Canada, we pay both federal and provincial taxes using a tiered tax rate system.

The tiered tax brackets generally change every year. The tax rates can change annually too. So, when you hear that someone is in the 25% or whatever tax bracket they mention, that does not mean that all their income is taxed at that rate. Tiered means that the Taxable Income is taxed at a variety of rates. Or rather if you are in the top bracket, only the Taxable Income dollars earned over and above $214,368 or $220,000 (federal and BC) would pay that highest tax rate.

For example, your Taxable Income is $120,000, you will pay federal tax blended between the first 3 brackets and provincial tax blended between the first 5 brackets. Using the federal side of the calculation only:

- the amount from $0 to $48,535 will pay at 15%;

- the amount from there up to $97,069 will pay at 20.5%; and

- the final difference up to $120,000 will pay at 26%.

And the provincial taxes would be calculated in the same way using their applicable brackets and rates.

After applying your Taxable Income to the various tax brackets and rates, we get the total taxes, federal and provincial, balance owing.

Credits

But before we finalize what you must pay, we get to add in the Credits. Credits reduce your overall federal and provincial taxes. Like tax rates and brackets, the tax credits can also change year-to-year. Some credits we have had for many years while others can come and go. Typical federal credits include:

- Basic personal amount (every tax filer is eligible to claim this)

- Spouse or common-law partner amount (when your spouse does not use any or all their basic personal amount)

- Age amount

- Canada caregiver amount

- CPP contributions & EI premiums (so you aren’t taxed twice)

- Volunteer firefighters’ amount

- Search and rescue volunteers’ amount

- Disability amount

- Adoption expenses

- Pension income amount

- Tuition & education credit

- Home buyers’ amount

- Canada employment amount

- Medical expenses

Each of these Credits has a value. While some are a set Credit amount (i.e. basic personal amount), some are based on the amount spent (i.e. medical expenses) and others have a threshold or minimum spend. The Credit amount often increases with inflation or changes with the annual budgets set both federally and provincially. As mentioned, the Credits noted above are some of the federal ones. Each province typically has their own and not all provinces offer the same credits as other provinces or even federally. When the province does offer the same federal Credit, the amounts are generally not the same either.

Once all your federal and provincial credits are determined, they are tallied up and the first tax bracket rate is then applied against this total. For example, the federal tax rate is 15% so if your total federal Credits are $20,000, you would save $3,000 off your federal taxes; the provincial tax rate is 5.06% so if your total provincial Credits are $10,000, you would save $506 off your provincial taxes.

Benefits

Now that your taxes are better understood, we get into the tax Benefits that you can receive by filing your taxes. This is often referred to as the “FREE” money however as you likely know, nothing in life is truly free. The Benefits are provided by the Government to help under specific situations and are often based on your income.

The most common Benefits are the GST Credit and Canada Child Benefit (CCB). The CCB is a monthly Benefit which has both a federal and provincial portion and are based on your Family Net Income. As your Family Net Income increases, the CCB decreases until you are no longer eligible. The GST Credit (which is really a Benefit hence the name confusions) is also based on your Family Net Income and is received 4 times a year. The Family Net Income is a calculation combining you and your spouse/common law partner’s Net Income and often adjusted for certain things (hence why we have a difference between Net Income and Taxable Income).

Other Benefits may include the Provincial Tax Credit (depending on your province) and the Canada Workers Benefit; both of which are Benefits paid through filing your personal tax return and are refunded at that time by increasing your tax refund or reducing the taxes that you owe. These Benefits are generally not taxable although historically, there have been Benefits that were taxable so anything is possible.

And there you have it, the basics of taxes here in Canada.

***This blog is for information only and not to be used as tax advice or planning without first seeking professional advice. Information is subject to change without notice.