Summer is almost here and after our never-ending 2020 tax season that extended right through and into our 2021 tax season, we couldn't be more relieved to see the light at the end of the tunnel.

We know it’s been a very long road for our small business clients and all Canadians (the world too), in general, but we are hopeful that COVID is slowly but surely becoming a nightmare that is soon to be a painful and distant memory of the past. Every single one of us was impacted in some way but we hope you have gained valuable insight from the last 15+ months, whether it be valuing your time with family and friends, seeing the benefits of having a cash safety blanket and/or realizing just how resilient and capable you are under extreme and unknown circumstances.

I know I have definitely learned a lot this past year and although am grateful for the life lessons, I will be even more grateful when I can hug everyone once again.

On that note, our summer hours are in effect so if you need any additional support and/or services, please make sure you give us plenty of notice.

Have a question? Email or call us. And remember to check out our blogs, checklists and social media pages for more information on all things small business, tax, accounting and the Tri-Cities community.

CANADA RECOVERY HIRING PROGRAM (CRHP): New Hiring Subsidy

The 2021 Federal Budget introduced the new CRHP which would provide eligible employers with a subsidy of up to 50% of the incremental remuneration paid to eligible employees in respect of June 6, 2021, to November 20, 2021. The higher of the Canada Emergency Wage Subsidy (CEWS) or CRHP may be claimed for a particular qualifying period, but not both.

Eligible Employers

Eligible Employers

Employers eligible for CEWS would generally be eligible for CRHP. However, a for-profit corporation would be eligible only if it is a Canadian-Controlled Private Corporation (subject to a few minor exceptions). Eligible employers (or their payroll service provider) must have had a CRA payroll account open since March 15, 2020.

Eligible Employees

The same employees eligible for CEWS are proposed to be eligible for CRHP, except that CRHP will not be available for furloughed employees.

Amount Of Subsidy

The subsidy is computed as the incremental remuneration multiplied by the applicable hiring subsidy rate for that period. The rate is 50% for the periods from June 6 - August 28, followed by 40% from August 29 - September 25, 30% from September 26 - October 23, and 20% from October 24 - November 20.

Incremental remuneration for a qualifying period means the difference between:

- an employer’s total eligible remuneration paid to eligible employees for the qualifying period, and

- its total eligible remuneration paid to eligible employees for the base period (March 14 to April 10, 2021).

The same types of remuneration eligible for CEWS would also be eligible for CRHP (i.e., salary, wages, and other remuneration for which employers are required to withhold or deduct amounts). The amount of remuneration for employees would be based solely on remuneration paid in respect of the qualifying period.

Eligible remuneration for each eligible employee would be subject to a maximum of $1,129 per week, for both the qualifying period and the base period.

Similar to CEWS, the eligible remuneration for a non-arm’s length employee for a week will also be limited based on their baseline remuneration (that is, their pre-COVID remuneration levels).

Required Revenue Decline

To qualify, the eligible employer is required to have experienced a decline in revenues. For the qualifying period between June 6, 2021 and July 3, 2021, the decline would have to be greater than 0%. For later periods, the decline must be greater than 10%.

Application Deadline

Similar to CEWS and CERS, an application for a qualifying period would be required to be made no later than 180 days after the end of the qualifying period.

ACTION ITEM: As only CEWS or CRHP can be claimed for a particular period, and each program has different parameters and benefits, consideration should be given to determine the best option.

COVID-19 BENEFITS FOR INDIVIDUALS: Period Extensions

The eligibility periods for several personal income replacement COVID-19 benefits have been extended:

- the previous limit of 26 weeks for the Canada Recovery Benefit (CRB) and Canada Recovery Caregiver Benefit (CRCB) will be extended by 12 weeks to 38 weeks;

- the previous limit of two weeks for the Canada Recovery Sickness Benefit (CRSB) will be extended to four weeks; and

- the normal limit of 26 weeks for Employment Insurance (EI) benefits will be extended by 24 weeks to 50 weeks.

In the absence of these extensions, individuals who transitioned to CRB or EI on September 27, 2020 could have reached the maximum claim period as early as March 27, 2021.

In addition, self-employed workers who have opted in to the EI program to access special benefits will be able to use a 2020 earnings threshold of $5,000 compared to the previous threshold of $7,555. This change will be retroactive to claims as of January 3, 2021 and will apply until September 25, 2021.

ACTION ITEM: More weeks of COVID-19 income support are now available. Make sure to file your 2020 personal tax returns to reduce the chance of interruptions in benefit receipt.

EXTENDED WAGE AND RENT SUBSIDIES: Details Released

On March 3, 2021, the Department of Finance announced details on the Canada Emergency Wage Subsidy (CEWS) and Canada Emergency Rent Subsidy (CERS) for the March 14 - June 5 periods. Later, the Federal Budget (April 19, 2021) announced an extension of these programs to September 25, 2021.

Revenue Comparison Reference Periods

Revenue Comparison Reference Periods

The reference periods will continue to use either of the two months ended prior to the end of the relevant period (so February or March 2021 for CEWS period 14/CERS period 7). However, the prior reference month to be used when comparing average monthly revenues from March onwards would be changed. Rather than comparing to the same month in 2020, the same month from 2019 would be used. For example, March 2021 revenues would be compared to March 2019 revenues rather than March 2020 revenues.

Rates For the periods between March 14 and July 3, 2021, the maximum CEWS subsidy rate is 75%, while the maximum CERS rate is 65%. Subsequently, the maximum rates for both CEWS and CERS will be the same, and decline gradually: 60% (July 4 - July 31), 40% (August 1 - August 28), and 20% (August 29 - September 25). The additional lockdown support to CERS will remain at 25% for the entire period (March 14 - September 25).

For the periods between March 14 and July 3, 2021, the maximum CEWS subsidy rate is 75%, while the maximum CERS rate is 65%. Subsequently, the maximum rates for both CEWS and CERS will be the same, and decline gradually: 60% (July 4 - July 31), 40% (August 1 - August 28), and 20% (August 29 - September 25). The additional lockdown support to CERS will remain at 25% for the entire period (March 14 - September 25).

Deadlines

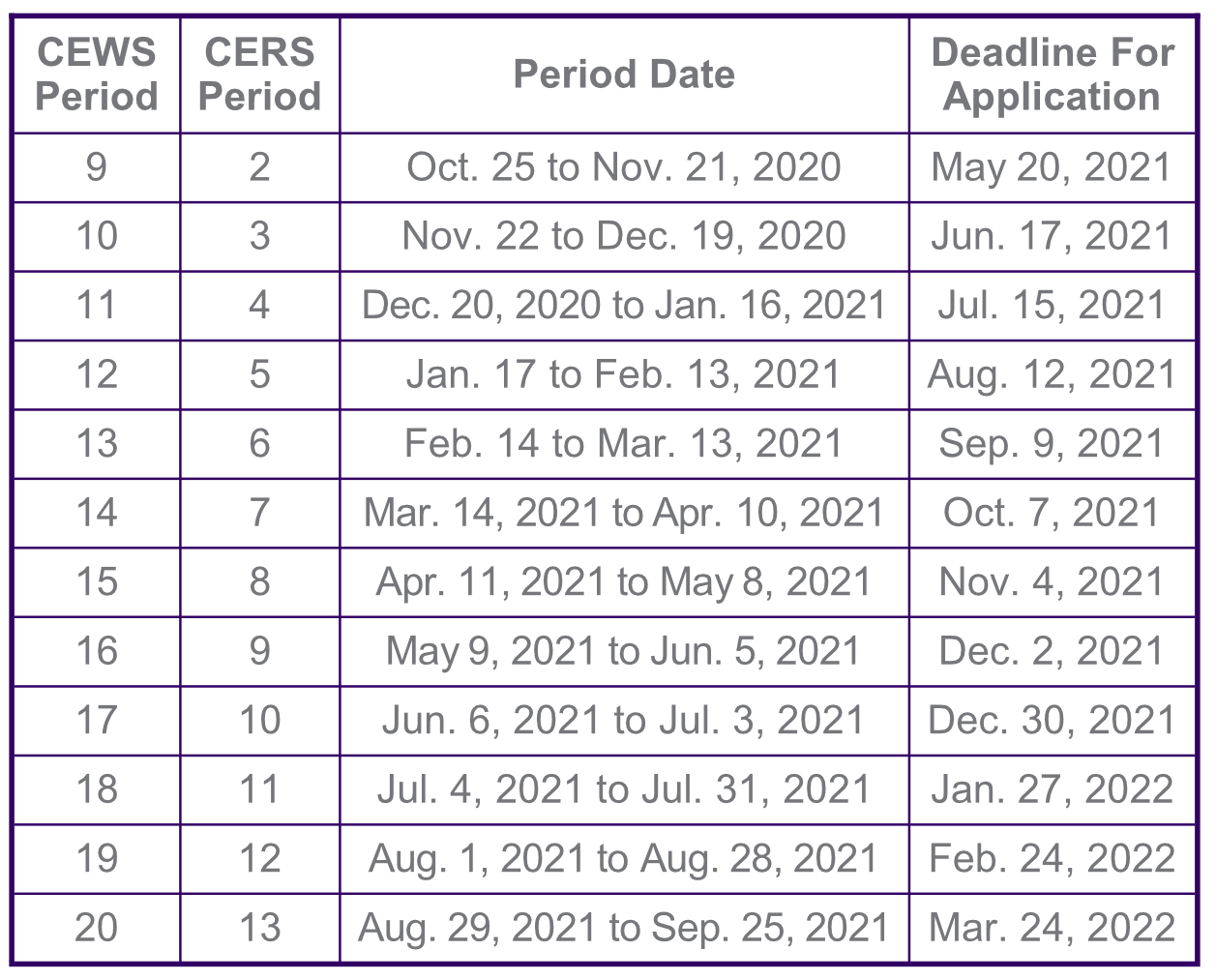

Both CERS and CEWS applications are due 180 days after the end of the qualifying period.

The chart summarizes the upcoming deadlines for the various periods currently announced.

CRA has recently advised that they may accept a late-filed application in exceptional circumstances. Requests must be made before the later of May 21, 2021 and 30 days after the filing deadline.

ACTION ITEM: Ensure to consider whether a claim should be made well before the deadline for application.

BENEFICIAL OWNERSHIP OF CORPORATIONS: More Information To Be Disclosed

There is a global trend emerging focused on requiring corporations to disclose the identity of their beneficial owners. Beneficial owners are generally individuals that either directly or indirectly exercise ultimate ownership or control over a corporation. (BC implemented this in October 2020.)

The 2021 Federal Budget in Canada provided $2.1 million to support the implementation of a publicly accessible corporate beneficial ownership registry by 2025. Some provinces have also commenced work on such disclosures.

As an example of what may come, consider the developments in the U.S. and U.K.

United States On January 1, 2021, the National Defense Authorization Act for Fiscal 2021 was enacted. This Bill contained the Corporate Transparency Act, which introduced significant disclosure of beneficial ownership requirements. The legislation will apply to private corporations and limited liability companies (LLCs) registered to do business in the U.S. (including both domestic and foreign corporations) but will exclude a few types of entities, such as publicly listed corporations. Identifying information of beneficial owners that have substantial control will be required to be disclosed for new entities and those entities that have changes. Information collected will be available to law enforcement agencies, but not to the general public.

On January 1, 2021, the National Defense Authorization Act for Fiscal 2021 was enacted. This Bill contained the Corporate Transparency Act, which introduced significant disclosure of beneficial ownership requirements. The legislation will apply to private corporations and limited liability companies (LLCs) registered to do business in the U.S. (including both domestic and foreign corporations) but will exclude a few types of entities, such as publicly listed corporations. Identifying information of beneficial owners that have substantial control will be required to be disclosed for new entities and those entities that have changes. Information collected will be available to law enforcement agencies, but not to the general public.

United Kingdom

In 2016, the U.K. launched a publicly accessible register of beneficial owners of companies (the register of Persons with Significant Control). The information displayed can basically be used by organizations and individuals without restriction. The minimum share percentage ownership at which disclosure is required is 25%.

ACTION ITEM: Identifying information disclosure of beneficial owners of corporations may be required in the near future.

RENTAL PROPERTIES: Major Repair Expenses

In a February 11, 2021 Tax Court of Canada case, the deductibility of rental expenses for a condo unit that underwent major repairs was considered.

In a February 11, 2021 Tax Court of Canada case, the deductibility of rental expenses for a condo unit that underwent major repairs was considered.

In 2010, major structural repairs (the exterior repairs) commenced on an entire condo complex. As a result, the taxpayer lost the tenants for his particular unit, and was unable to replace them. As the property was empty, the taxpayer decided to carry out repairs within the condo itself (the interior repairs) costing approximately $24,000. The repairs consisted of fixing or replacing items such as fixtures, appliances, walls, and counters.

Taxpayer Wins – Source Of Income

CRA argued that since the property was not being rented out, there was not a source of income and the expenses could not be deducted. However, the Court found there was a source of income since there was a continuing intent to earn a profit, demonstrated by several attempts to rent the property during the external structural repair phase. The property was also rented out after the repairs were completed, and the Court observed that the taxpayer operated in a business-like manner.

Taxpayer Wins – Current vs. Capital

The Court then considered whether all of the repairs could be deducted immediately as current expenses, or must be depreciated over time as capital expenses. In ruling that the interior repairs were a current expense, the Court noted the following:

- Betterment and enduring benefit – Although any repairs improve a property, the question is whether the improvement was significant enough to bring into existence a different capital asset than what was there before. No building permits were required; no redesign or change to size, layout, or function occurred; and materials used were “like for like” (no upgrades). No new asset resulted; rather, the property was just kept in rentable condition. The Court also noted that being a “once in a lifetime” expenditure does not mean it is not a repair.

- Typical repairs – If repairs are out of the ordinary, the expenditures are more likely on account of capital. However, these repairs, even though they occurred infrequently, were typical.

- Timing of the repairs – CRA argued that since the repairs were all done at once, they resulted in a new asset. However, the Court noted that the test is only whether the cumulative effect of the repairs was to improve the property past its original condition. The Court found that the timing of the repairs was not a significant factor.

- Cost of repairs compared to value of the property – The cost of the repairs was only 5% of the total fair market value of the property, suggesting that the expenses were current rather than capital.

- Increase in rent – The rent increased from $1,500 to $2,200 after the repairs were complete. The Court opined that the increase in rent was just as likely attributable to exterior repairs as to the interior repairs and that the increase in rent was not a significant factor. It was not surprising that property in good state commands higher rent than one needing repairs.

ACTION ITEM: If considering a major renovation to a rental property, consider whether the repairs require delayed deduction, or can be immediately deducted.

TAXPAYER RELIEF: Financial Hardship

In a January 14, 2021 Federal Court case, the taxpayer sought a judicial review of CRA’s denial to provide interest and penalty relief on a tax debt of nearly $400,000. The taxpayer argued that relief should be granted due to financial hardship and inability to pay. While the taxpayer provided information demonstrating that monthly expenses and income resulted in a deficit, the taxpayer’s own statements referring to his assets suggested that there was more to his financial situation.

In a January 14, 2021 Federal Court case, the taxpayer sought a judicial review of CRA’s denial to provide interest and penalty relief on a tax debt of nearly $400,000. The taxpayer argued that relief should be granted due to financial hardship and inability to pay. While the taxpayer provided information demonstrating that monthly expenses and income resulted in a deficit, the taxpayer’s own statements referring to his assets suggested that there was more to his financial situation.

Taxpayer Loses

The Court supported CRA’s view that assets and liabilities, not just income and expenses, were relevant to the question of financial hardship, and information requested on his assets had not been provided.

The Court ruled that, as it appeared that the taxpayer could pay the debt arrears by selling assets, it was not unreasonable for CRA to deny relief. The Court also stated that financial hardship is “the prolonged inability to afford basic necessities such as food, clothing, and shelter and reasonable non-essentials” reiterating the high bar to demonstrate financial hardship.

ACTION ITEM: Be aware that interest relief requested on the basis of financial hardship is very difficult to obtain.

GUARANTEED INCOME SUPPLEMENT: More People Are Now Eligible

As many individuals had lower income in the 2020 year, some may be surprised that they are eligible to receive the Guaranteed Income Supplement (GIS). In addition, changes in July 2020 allow individuals to earn more without eroding benefits. For those who have been eligible for some time, GIS (and OAS) can be applied for retroactively (up to eleven months back).

Individuals over the age of 65, living in Canada, receiving OAS and having income not exceeding certain thresholds, will qualify for GIS. A single, widowed or divorced individual must have income below $18,648. The combined income of a married or common-law couple cannot exceed the following:

Individuals over the age of 65, living in Canada, receiving OAS and having income not exceeding certain thresholds, will qualify for GIS. A single, widowed or divorced individual must have income below $18,648. The combined income of a married or common-law couple cannot exceed the following:

- $24,624 if the spouse/common-law partner receives the full OAS pension;

- $44,688 if the spouse/common-law partner does not receive an OAS pension; and

- $44,688 if the spouse/common-law partner receives the allowance.

Income for this purpose is generally net income on the personal tax return (line 23600) with the most notable difference being the exclusion of OAS, GIS and related payments. CPP and EI premiums can also be deducted against income. In addition, effective July 2020, up to $5,000 of employment and self-employment income annually is exempted. For those earning between $5,000 and $15,000, 50% of income earned in this bracket is also exempted.

Payments from July to June are based on the previous year’s income. So, the 2020 personal tax return will impact benefits from July 2021 to June 2022.

Also, note that individuals outside Canada for more than six months cannot collect GIS. Service Canada and the Canada Border Services share information.

ACTION ITEM: Review whether you or a relative may be eligible for GIS as soon as possible. Retroactive applications can only be made for the previous 11 months.

IMMEDIATE CAPITAL ASSET WRITE-OFF: Budget 2021

The 2021 Federal Budget proposed to allow immediate expensing of certain property acquired by a Canadian-Controlled Private Corporation (CCPC) on or after April 19, 2021 (Budget Day) and before 2024. Up to $1.5 million per taxation year is available (shared among associated CCPCs and prorated for short taxation years), with no carry-forward of excess capacity.

The 2021 Federal Budget proposed to allow immediate expensing of certain property acquired by a Canadian-Controlled Private Corporation (CCPC) on or after April 19, 2021 (Budget Day) and before 2024. Up to $1.5 million per taxation year is available (shared among associated CCPCs and prorated for short taxation years), with no carry-forward of excess capacity.

Property eligible for this immediate write-off is quite broad. It includes all depreciable capital property, other than certain assets with particularly long lives, such as buildings, physical infrastructure, pipelines and goodwill. As such, property acquired in the course of business, such as computers, vehicles, tools and machinery and equipment, would be eligible.

As this immediate write-off is discretionary, planning should be afforded to consider current and future profits.

Where capital costs of eligible property exceed $1.5 million in a year, the taxpayer would be allowed to decide which assets would be deducted in full, with the remainder subject to the normal CCA rules. Other enhanced deductions already available, such as the full expensing for manufacturing and processing machinery or zero-emission vehicles, would not reduce the maximum amount available.

Generally, property acquired from a non-arm’s length person, or which was transferred to the taxpayer on a tax-deferred “rollover” basis, would not be eligible. Also, while the taxpayer can always claim less than the maximum, claims in future years would be limited to the usual CCA rates.

ACTION ITEM: An immediate full write-off of many capital assets may provide an incentive to acquire capital assets.

TAX TICKLERS

- The Canada Emergency Business Account (CEBA) application deadline (for either the $20,000 extension, or the full $60,000) has been extended from March 31 to June 30, 2021.

- If you missed out on the 2020 COVID-19 enhanced GST credit or Canada child benefit, because no 2018 tax return was filed, you can file it now to get retroactive benefit payments.

- The Canada Recovery Benefit (CRB), Canada Recovery Caregiver Credit (CRCB), and Canada Recovery Sickness Benefit (CRSB) are not available to individuals during mandatory quarantine or self-isolation following a return from international travel, effective January 3, 2021.

**This publication is a high-level summary of the most recent tax developments applicable to business owners, investors, and high net worth individuals. This information is for educational purposes only. As it is impossible to include all situations, circumstances and exceptions in a newsletter such as this, a further review should be done by a qualified professional. No individual or organization involved in either the preparation or distribution of this letter accepts any contractual, tortious, or any other form of liability for its contents. For any questions… give us a call.