At this time of year aka tax season, I am inundated with the following question…

At this time of year aka tax season, I am inundated with the following question…

“How much should I contribute to my RRSP?”

Now let me tell you, that’s an extremely loaded question. There is no simple answer to this question nor is there a one-size fits all because there are lots of factors to consider in determining not only how much to contribute but also is that the best way to invest your money. Not to mention, how much do you have available to invest?

A very wise person (my dad) once told me long before I became an accountant that if you’re making a decision based on tax only then it’s the wrong decision. And he was right! As I’ve learned from being an Accountant for over 20+ years now, if you are deciding on something that only impacts your tax refund then you need to start looking at the bigger picture.

So, a few questions for you to start thinking about when you’re considering your RRSP contributions. And keep in mind, RRSP contributions give you a tax deduction now, but you will pay tax on the amount when it’s withdrawn.

- How much do you make?

My general rule of thumb for investing in an RRSP is when your taxable income is greater than about $107,000. One of the tax advantages for RRSPs comes if you contribute when you are in a higher tax bracket, and you withdraw the RRSPs when in a lower bracket which can often be the case in retirement. If your taxable income is below $107,000, investing in RRSPs might not be the best use of your dollars as your income during retirement might have you in a higher tax bracket than while working. - How long are you investing for?

RRSPs are meant to be long-term investments. If you are going to need the money in the short term (not including withdrawing for post-secondary education or buying a house), this is not a great strategy for saving as you will have to pay tax on it when withdrawn and if you have your normal income in that year, the RRSP income will increase your taxable income and taxes. - Do you have a pension?

When you have a good pension, contributing to RRSPs might not make the most tax sense because when you retire, you will have many income sources (i.e. CPP, OAS, pension, RRSP/RRIF) plus anything else you might have (i.e. rental income). This could result in higher taxes when you retire compared to the taxes you are paying while working.

I’ve seen many situations where the now retired scrimped and saved to contribute to RRSPs while also paying into a pension to now in retirement paying more tax than they did while working and raising a family.

When you have a good pension, contributing to RRSPs might not make the most tax sense because when you retire, you will have many income sources (i.e. CPP, OAS, pension, RRSP/RRIF) plus anything else you might have (i.e. rental income). This could result in higher taxes when you retire compared to the taxes you are paying while working.

I’ve seen many situations where the now retired scrimped and saved to contribute to RRSPs while also paying into a pension to now in retirement paying more tax than they did while working and raising a family. - What is your overall retirement strategy?

Have you spoken with an investment advisor to see what you need for retirement? Have you considered whether the TFSA is better than an RRSP given your short and long-term goals?

As I mentioned, “How much should I contribute to my RRSP?” is not a simple question and while the above is not a comprehensive list of considerations, it is a good starting place.

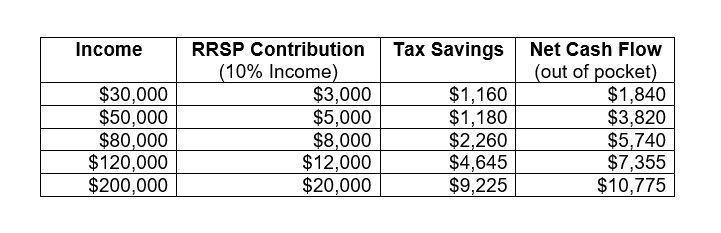

In the meantime, here’s a simple table to give you an idea of what your tax savings might be assuming some very basic information.

Scenario: One person living in BC with employment income and eligible for the basic tax credits only. Using 2021 Federal and BC tax rates.

General Tax Planning Tips

General Tax Planning Tips

- Tax planning is year-round and not just during tax season. Consult with your professional advisors’ multiple times throughout the year to discuss changes and goals for both now and your future.

- DO NOT take a loan for your RRSP contributions BEFORE discussing with your Tax Accountant. RRSP loans are often recommended by the banks/credit unions tellers who may not be familiar with your tax situation and are often sold with the impression that “your tax refund will repay the loan” however you don’t pay tax at 100% so your refund from the RRSP alone will never repay the full loan amount. For example, a $10,000 loan will not result in a $10,000 tax refund. Plus, if you are self-employed and don’t pay personal tax instalments, the RRSP contribution will only reduce your tax balance owing. In 20+ years, I have yet to see the loan scenario be worthwhile. If RRSPs are the right choice for your tax planning, consider starting with smaller monthly amounts.

- When your income is low (under $107k), consider using a TFSA. While it might not give you the tax savings, it does allow you to save without any tax implications.

At the end of the day, both tax savings and saving for the future are important. And RRSPs are often one of the best ways to accomplish the tax savings however it also needs to be the right financial plan for you. Always best to discuss with your professional financial team first.

***This blog is for information only and not to be used as tax advice or planning without first seeking professional advice. Information is subject to change without notice.