As an employer, you are required to withhold payroll taxes (CPP, EI & Income Tax) from your employees wages. In addition, you are required to pay an employers’ portion of CPP ($2,898 max for 2020) and EI ($1,198.90 max for 2020). These amounts increase annually. EI is based on the maximum annual insurable earnings while CPP is based on the maximum annual pensionable earnings (average wage increases in Canada).

As an employer, you are required to withhold payroll taxes (CPP, EI & Income Tax) from your employees wages. In addition, you are required to pay an employers’ portion of CPP ($2,898 max for 2020) and EI ($1,198.90 max for 2020). These amounts increase annually. EI is based on the maximum annual insurable earnings while CPP is based on the maximum annual pensionable earnings (average wage increases in Canada).

EI is considered to be a self-funded program and although over the past few years, the EI rate has generally gone down (1.58%, 1.62%, 1.66%, 1.63%, 1.88% for 2020 to 2016, respectively), the maximum annual insurable earnings has increased every year, resulting in these amounts generally having an overall increase each year (or marginal decline), with the exception from 2016 to 2017, when after 4 years at 1.88%, it went down.

The standard employer rate is 1.4 times the employees’ portion. The federal rate for 2020 is 1.58% for the employee portion and roughly 2.212% for the employer portion.

With COVID-19, we can only assume these rates are about to skyrocket.

As a small business owner, how can you mitigate these increases?

This can be achieved when you offer your employees a short-term disability plan.

To qualify, there are a few basic requirements that must be met by the plan. Some of which include:

- Provide at least 15 weeks of benefits for short-term disability;

- Benefits paid must match or exceed the level of benefits that an employee would otherwise receive through EI;

- Waiting period for payment of benefits cannot be more than 7 consecutive days;

- Be accessible to employees within 3 months of hiring;

- The plan must not include the employee claiming EI benefits as part of the payment structure; and

- Cover employees on a 24-hour-a-day basis.

You must also provide evidence of your commitment to provide a short-term disability plan and return 5/12 of the savings to your employees. Some methods of returning the savings to your employees include:

- Cash remittances (paid directly to your employees);

- New employee benefits (i.e. adding a dental plan or group life insurance, providing free beverages or social activities); or

- Increasing or upgrading existing employee benefits (i.e. more holidays or time off work).

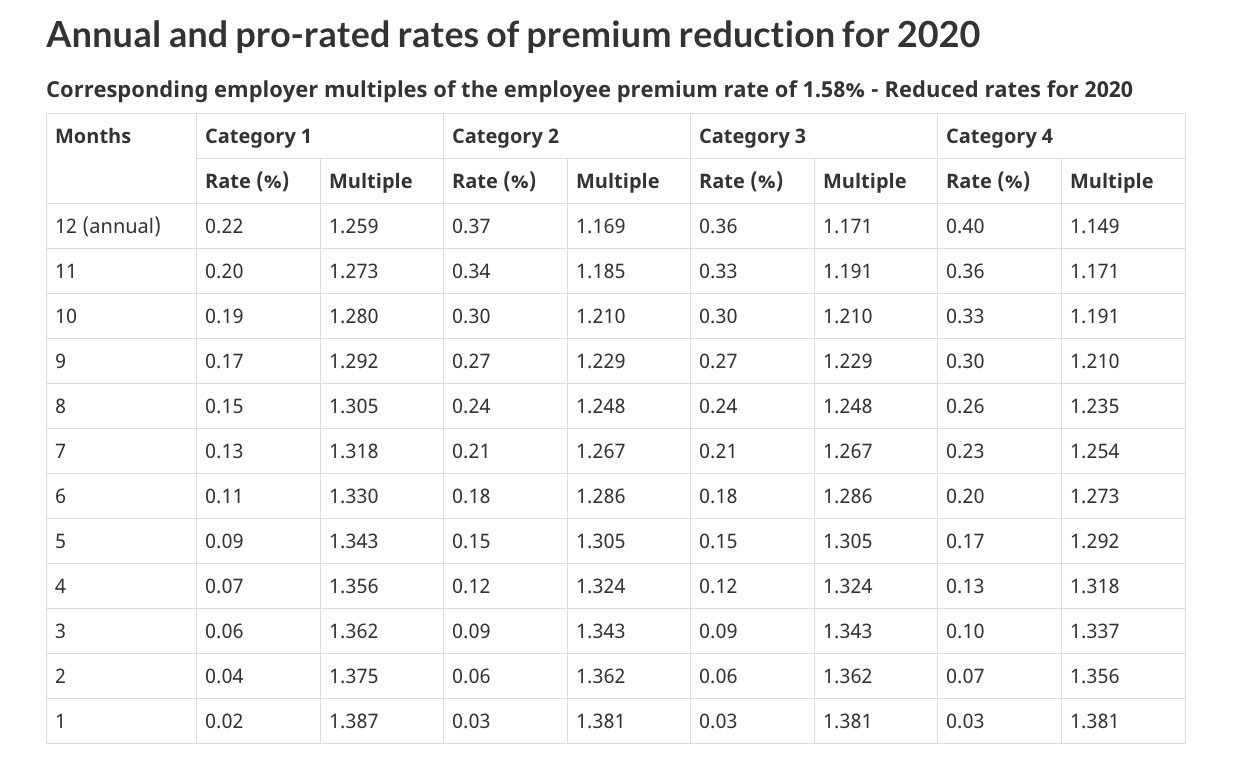

If you meet all the requirements and are granted an EI premium reduction, your reduced rate will depend on the category your plan falls under.

We recommend that you connect with your benefits provider to see if you qualify or how you can modify your plan to be eligible, which should include reviewing a cost analysis prior to finalizing any changes. The application form is also available online.

***This blog is for information only and not to be used as tax advice or planning without first seeking professional advice. Information is subject to change without notice.