Life insurance is important, and everyone should consider owning some, to ensure their loved ones are taken care of financially for when life events happen.

Life insurance is important, and everyone should consider owning some, to ensure their loved ones are taken care of financially for when life events happen.

But did you know that your small business corporation can purchase the life insurance for you?

WHAT IS CORPORATE-OWNED LIFE INSURANCE?

Small business corporations can apply for life insurance on behalf of the shareholders. The corporation would pay the policy premiums and would also be the beneficiary. Upon death, the corporation would then receive the insurance proceeds tax-free.

TYPES OF LIFE INSURANCE

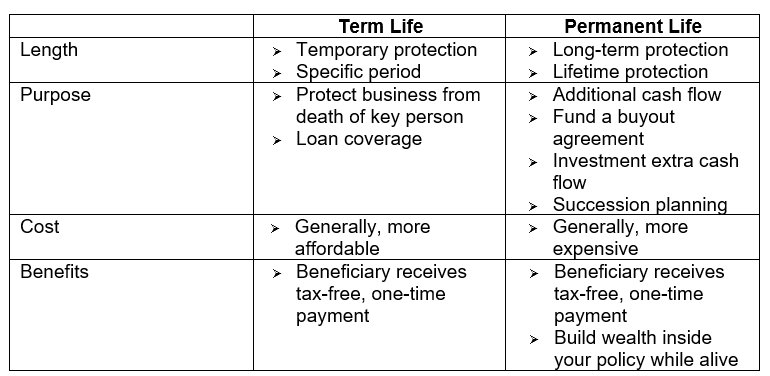

There are various types of life insurance available but generally categorized as either “Term” or “Permanent”.

Term life insurance is the most basic type of life insurance which provides coverage for a specific period of time (i.e. 10 or 20 years) and is generally the least expensive in the short run.

Permanent insurance is designed to remain in force until death and includes universal life, whole life, and term to 100 policies.

TAX ADVANTAGES TO CORPORATE OWNED LIFE INSURANCE

More Bang For Your Buck

You can buy more insurance with corporate funds than with personal funds. Life insurance premiums are generally paid with after-tax dollars. When your corporation’s tax rate is lower than your personal tax rate (often the case for a small business owner), the cost of the premiums is lower when paid by a corporation rather than personally.

You can buy more insurance with corporate funds than with personal funds. Life insurance premiums are generally paid with after-tax dollars. When your corporation’s tax rate is lower than your personal tax rate (often the case for a small business owner), the cost of the premiums is lower when paid by a corporation rather than personally. Tax-Free Proceeds

To receive the insurance proceeds tax-free, the corporation is the owner and beneficiary of the policy. The proceeds received by the corporation are tax free and an equivalent amount, net of the tax cost of the policy, is added to the company’s capital dividend account (CDA). This can then be paid out to the shareholder’s estate tax-free as a capital dividend. This CDA can be paid out immediately or at a chosen time in the future.

Beneficial For Business Loans

Some lenders require that the business loan is personally guaranteed by the owner(s). Due to this, they might also require that life insurance be purchased for the duration of the loan as collateral. When there is a lending requirement, a portion of the insurance premiums would be tax deductible too.

Corporate owned permanent life insurance can also be an asset on your balance sheet which can be used to increase your borrowing power.

Keep in mind, even if the lender does not require it, you will want to protect your estate and loved ones, as they could be liable for the outstanding loan.

Key Personal Replacement

Most individuals plan what will happen to their personal assets when the unfortunate day comes. However, the plan to replace your position in your company can often be overlooked. If you are the single shareholder of your company, it can put a financial strain on your business if a key person is not hired right away to replace you. Life insurance can provide your business with the extra cash flow for working capital, debt repayment, the time to hire and train a replacement and/or prepare the business for sale.

Tax-Free Growth

Universal and whole life policies can offer a tax-free savings and investment component where additional funds are paid into the policy, forming the investment component. This can then grow tax free in the policy and lead to higher proceeds when the insured person passes away.

Universal and whole life policies can offer a tax-free savings and investment component where additional funds are paid into the policy, forming the investment component. This can then grow tax free in the policy and lead to higher proceeds when the insured person passes away.

Everyone’s personal and business financial situation looks different. But planning for the future is key to removing the scariness of the unknown for your loved ones after your death. Whether you choose to opt in or out of corporate owned life insurance (or any life insurance), it is really important to take a closer look at your business and what may be beneficial for it as well as your estate. Consulting with your professional team (Financial Advisor, Lawyer, Accountant) is the first step and highly recommended.

SUMMARY OF TERM VS. PERMANENT

***This blog is for information only and not to be used as tax advice or planning without first seeking professional advice. Information is subject to change without notice.